- OneZero-F Daily Insights

- Posts

- Markets, Rates & Recession Fears-What You need to know Now.

Markets, Rates & Recession Fears-What You need to know Now.

Also learn daily routines that define the Wealthy Mindset

Read time: Under 4 minutes

Welcome Back Investor!

The global economy is entering choppy waters! From escalating U.S. tariffs shaking up India’s GDP projections to JPMorgan’s red alert on a possible worldwide recession-the financial world is buzzing with pivotal shifts. In this week’s spotlight-packed newsletter, we unpack the most critical updates-from crashing pharma stocks and rising Asian currencies to expert rate-cut predictions and top investment ideas.

Stay ahead of the curve and get ready to pivot smarter!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

Focal Point: How U.S. duties could cool India's Growth and trigger fresh rate cuts in 2025

Markets

Everything else you need to know today

Mindset: Daily routines that define the Wealthy Mindset

Supercharge your Investing Skills with this Video

Stock Screener to up your game

FOCAL POINT

How U.S. duties could cool India's Growth and trigger fresh rate cuts in 2025

The recent imposition of a 26% reciprocal tariff by the United States on Indian goods is poised to impact India's economic landscape significantly. Here's an analytical breakdown:

1. Economic Growth Implications

✅GDP Growth Projection: Analysts predict a deceleration in India's GDP growth by 20-40 basis points for the fiscal year 2025-26. This adjustment could bring growth down from the Reserve Bank of India's (RBI) forecast of 6.7% to approximately 6.3%-6.5%.

✅Sectoral Impact: Key export sectors such as electronics (approximately $14 billion) and gems and jewelry (over $9 billion) are expected to bear the brunt of these tariffs, potentially leading to reduced export volumes and revenue.

2. Monetary Policy Adjustments

✅Interest Rate Cuts: In response to the anticipated economic slowdown, the RBI is likely to implement further interest rate cuts. Following a 25 basis point reduction in February, projections suggest an additional 75 basis points cut within the year, potentially bringing the policy repo rate down to 5.5%, the lowest since August 2022.

✅Inflation Considerations: With inflation expected to average around 4.2%, aligning closely with the RBI's target, there is room for monetary easing to support growth without stoking significant inflationary pressures

3. Currency and Trade Dynamics

✅Rupee Valuation: The Indian rupee has shown resilience, appreciating past the 85/USD mark. This strength is partly attributed to a weakened U.S. dollar amid global trade tensions. Notably, the RBI's decision to refrain from intervening in the currency market has surprised many analysts.

✅Comparative Advantage: India's tariff rate of 26% is relatively lower than those imposed on other Asian nations, such as China's 34% and Vietnam's 46%. This differential may position India more favorably in certain export markets.

4. Stock Market Response

✅Market Performance: Indian stock indices have experienced declines in line with global trends. However, the relatively lower tariffs on Indian goods have limited losses compared to other Asian markets.

✅Sectoral Movements: The IT sector has faced significant downturns due to concerns over reduced U.S. client spending. Conversely, pharmaceutical stocks have shown resilience, buoyed by exemptions from the recent tariffs.

5. Strategic Outlook

✅Policy Measures: To mitigate the adverse effects of the tariffs, the Indian government may consider a combination of monetary easing, fiscal incentives, and structural reforms aimed at enhancing domestic demand and diversifying export markets.

✅Long-Term Considerations: While the immediate focus is on cushioning the short-term impacts, it's imperative for policymakers to address underlying structural issues to bolster the economy's resilience against external shocks.

While the U.S. tariffs present notable challenges to India's economic trajectory, a strategic blend of policy interventions and market adaptations can help navigate this complex landscape.

MARKETS

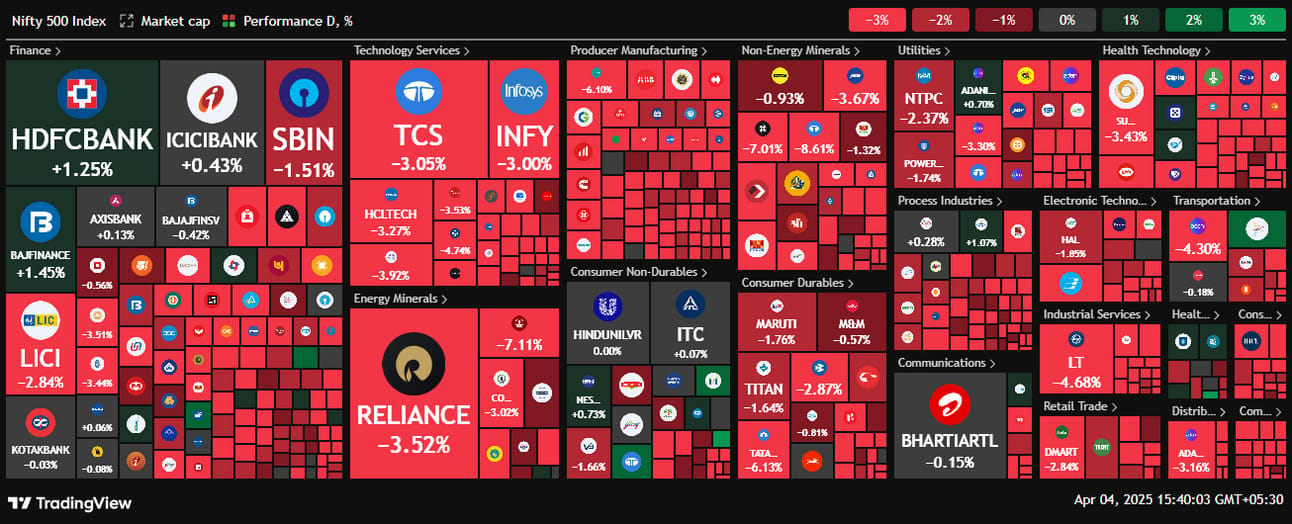

Indian markets witnessed a sharp sell-off, with the Sensex falling 930 points (-1.22%) and the Nifty 50 dropping 345 points (-1.49%), reflecting widespread investor caution. The Nifty Midcap 100 plunged nearly 3%, signaling stronger pressure on broader market segments, while the Nifty Bank remained relatively stable, down just 0.18%. The market downturn is largely attributed to global uncertainties, including U.S. tariff tensions and rising recession fears, fueling a risk-off sentiment across sectors.

Closing figures as on 04.04.25 (3.30pm IST)

🔻 SENSEX | 75,364.69 | -1.22% |

🔻 NIFTY 50 | 22,904.45 | -1.49% |

🔻 NIFTY BANK | 51,502.70 | -0.18% |

🔻 NIFTY Midcap 100 | 50,645.95 | -2.91% |

🔻 NIFTY Smallcap 100 | 15,675.95 | -3.57% |

🔎 In Focus

Sectorial Performance:

✅ Top 3 Gainers

TATA Consumer Products

Rose 1.57% to ₹1,087.85

Seen as a defensive play amid market uncertainty, supported by stable demand.

Bajaj Finance

Gained 1.45% to ₹8,718.85

Investors bet on financial resilience and strong lending outlook.

HDFC Bank

Up 1.25% to ₹1,817.30

Continued strength backed by Q4 optimism and strong institutional interest.

🔻Top 3 Losers

Tata Steel

Dropped by 8.61% to ₹140.39

Hit hard by global tariff tensions and metal price volatility.

High volume (80.82M) shows heavy institutional selling.

Hindalco

Fell 8.07% to ₹599.95

Reacting to weak global demand outlook for aluminum and trade headwinds.

ONGC

Declined 7.11% to ₹226.01

Pressure from crude price fluctuations and global risk-off sentiment.

NIFTY 500: Red Sea 🌊

FPIs ACTION

Top 5 Sectors where FPIs were net Buyers from 16.03.25 to 31.03.25

SL No. | Sectors | Rs. In Cr. |

|---|---|---|

1 | Financial Services | 17,585 |

2 | Telecommunication | 3,413 |

3 | Healthcare | 2,138 |

4 | Power | 1,627 |

5 | Capital Goods | 1,613 |

Top 5 Sectors where FPIs were net Sellers from 16.03.25 to 31.03.25

SL No. | Sectors | Rs. In Cr. |

|---|---|---|

1 | Oil, Gas & Consumable Fuels | -2,449 |

2 | Information Technology | -1,517 |

3 | Consumer Services | -1,158 |

4 | Fast Moving Consumer Goods | -487 |

5 | Construction Materials | -132 |

Source: Click here

FROM THE FRONTIER

Everything else you need to know today

Image Credits: Pixabay

🌩️Shockwave: JPMorgan's Chief Economist Bruce Kasman raises the alarm, escalating the likelihood of a global recession to 60% in light of President Trump's aggressive tariff strategies. The anticipated fallout includes retaliatory measures, dampened U.S. business sentiment, and disrupted supply chains.

⚡Jolt: President Trump hints at impending, unprecedented tariffs targeting the pharmaceutical sector, sending shockwaves through the market. The Nifty Pharma index plummeted over 4.5%, with major players like Aurobindo Pharma and Lupin experiencing significant declines.

🚀Surge: Emerging Asian currencies, led by the South Korean won, are on the rise as concerns over U.S. tariffs weigh heavily on the dollar. This shift underscores the dynamic interplay between global trade policies and currency valuations.

🎯Spotlight: All eyes are on Federal Reserve Chairman Jerome Powell as he prepares to address the economic outlook amidst escalating trade tensions. His insights are eagerly awaited for indications on future monetary policy directions.

🌤️Cooldown: India's services sector experiences a slight deceleration in growth for March, with the HSBC India Services PMI slipping to 58.5 from February's 59.0. Notably, inflationary pressures have eased, offering a nuanced perspective on the nation's economic trajectory.

💡Opportunity: In a market facing downturns, Motilal Oswal highlights strategic 'Buy' recommendations, spotlighting sectors like financials and real estate. This guidance aims to navigate investors toward potential growth avenues amidst prevailing volatility.

📝 Order Wins

✅K2 Infragen Ltd has officially revoked its 67.61 MWp Solar EPCC order at Khavda, Gujarat, due to scope changes and failed pricing negotiations.

✅Dynamic Services & Security Ltd secured a new contract worth ₹94 lakh from South Eastern Railway for mechanized housekeeping and scrap handling across carriage shop sites.

✅Trishakti Industries Ltd has bagged a ₹6 crore contract from NCC Ltd to supply advanced earth-moving equipment for a major infrastructure project.

💰 Fund Raising

✅HUDCO board has approved a massive fund-raising plan of ₹65,000 crore for FY 2025-26, alongside a proposal to hike its borrowing limit to ₹2.5 lakh cr from existing limit of ₹1.5 lakh Cr.

✅Veerkrupa Jewellers Ltd has announced a Rights Issue worth ₹49 crore, aiming to issue fully paid-up equity shares to existing shareholders.

ONEZERO-F ACADEMY

Daily routines that define the Wealthy Mindset

Source: ChatGPT

Daily habits play a crucial role in shaping an individual's financial success. Consistent routines such as early rising, self-education, strategic networking, disciplined financial management, and positive mindset practices contribute significantly to long-term wealth accumulation and personal development. These behaviors, though simple, form the foundation of a sustainable and prosperous lifestyle.

✅ These habits will change your lifestyle

🌅Wake Up Early: Starting the day early boosts productivity and allows quiet time for planning and self-discipline.

📖Read Daily: Reading sharpens the mind and builds knowledge in finance, leadership, and success strategies.

🏃♂️Exercise Regularly: Staying active enhances energy, focus, and resilience—key traits for long-term achievement.

🤝Network Strategically: Strong networks create access to ideas, mentorship, and opportunities that accelerate growth.

📊Track Finances: Monitoring expenses and budgeting builds awareness, prevents waste, and supports wealth growth.

💰Invest Consistently: Regular investments grow wealth passively and prepare for future financial independence.

🌐Diversify Income Streams: Multiple income sources reduce risk and create more stability and freedom.

🎯Set Goals Daily: Daily goal setting keeps actions aligned with vision and drives consistent progress.

🙏Practice Gratitude: Gratitude fosters positivity, mental well-being, and a more balanced approach to success.

🧠Prioritize Financial Education: Financial literacy empowers smarter decisions and adapts you to changing markets.

SOCIAL MEDIA SPEAKS

Just-in

CHINA ANNOUNCES EXTRA 34% TARIFFS ON US GOODS

— RedboxGlobal (@RedboxWire)

10:17 AM • Apr 4, 2025

SUPERCHARGE YOUR INVESTING SKILLS

Raamdeo Agrawal Explains 72 rule & Power of compounding | Exploring Minds

STOCK SCREENER TO UP YOUR GAME

Stocks Below Intrinsic Value

by Navendu

Current price < Graham Number AND

Sales growth >10% AND

Profit growth >10% AND

Return on equity > 10% and

Debt to equity <1.1 and

Current price >20Your Wish is my Command!

What did you think of today's email?Your feedback helps me create better emails for you! |

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until Sunday with our Startup Special!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES